For most aesthetics practitioners, finances are not their forte – nor should they be.

Balancing top-notch care with financial intricacies can quickly become overwhelming.

It steals valuable patient-focused time and burdens your team with admin tasks, leaving room for invoice errors, payment delays, and poor patient feedback.

But wait — why feel the pressure of manual invoicing when you can shake it off?

In medical spas and salons, patient care comes first, while everything else should run seamlessly in the background. One way to do this is to automate the complex processes you can’t — or don’t want to — handle yourself, i.e. invoices and payments.

This is where Xero can be a true game-changer for your medical spa and salon, helping efficiently handle complex financial processes that might be out of your comfort zone:

✔️ Automate piles of paperwork and manual entries to eliminate billing errors

✔️ Create a hassle-free experience for your team and your patients

✔️ Get on top of payments, invoices, reports, and taxes using real-time data

✔️ Pinpoint where your revenue is coming from and take steps to boost it

Sounds like a relief already? It really is. Dive right into our guide as we discuss what Xero is, how it elevates finance management, and how you can set it up for maximum salon and spa success.

What is Xero?

Xero is cloud-based accounting software for small and medium-sized businesses, including salons and spas, that need accurate and real-time finance management.

The easiest way to think of Xero is as a digital filing cabinet for your practice’s finances. Just like you would store your important papers in a physical filing cabinet to keep them organized and accessible, Xero stores your invoices and payments in a cloud-based space. It processes them much faster and more accurately than any person will.

Essentially, Xero can help your salon or spa:

- Access real-time financial data, anytime, on any device

- Make tax filing, auditing, and reporting simple

- Get daily financial reports, so you’re always up-to-date

- Process your invoices and payments faster, without the faff

Essentially, Xero ensures easier financial management for your aesthetics business. Spending less time in front of the PC means having more time for what matters the most — your patients.

Xero integration for salons and spas

Xero is a standalone platform, yes. But, it can also integrate into any software your salon or spa uses. This is very convenient because it allows you to tailor Xero based on your existing software. With Xero integration for salons and spas, you can:

Swap: Spending time manually managing invoice and payment records each day

For: Automatically receiving, monitoring, and storing them in an organized dashboard, seamlessly integrated into patient records.

Swap: The complex process of matching bank payments to invoices

For: Easily matching payments to their invoices. Get a clear view of active, completed, failed, and pending invoices directly from patient records.

Swap: Manual coordination of invoice and payment data

For: Syncing invoice and payment data seamlessly. Improve data coordination by identifying revenue sources easily and boosting your marketing strategy.

Using Xero in Pabau

Xero already integrates with over 1,000 applications, one of which is Pabau.

If you’re already using Pabau to manage your salon or spa, you can now easily monitor invoices and payments, as well as specific products and services. It’s all stored and accessible in Pabau — while Xero does the “money math” in the background.

The sync between your Pabau and Xero is automatic and can be configured in no time. Once you connect the two apps, which we discuss below, your financial data will be instantly pushed — from Pabau, into Xero. Xero will process every invoice you generate in Pabau, and record all financial data in Pabau.

Xero and Pabau are also cloud-based platforms, so medical teams can access financial details simultaneously, whenever, on all devices. Having more visibility at your fingertips means being able to take immediate action if, say, an invoice fails to process.

Let’s zero in on five more ways in which Xero for Pabau can revolutionize medical spas, practices, and salons.

5 advantages of integrating Xero into Pabau

Running a busy clinic, salon, or spa leaves very little time for managing your cash flow. Here’s how you can use Pabau with Xero to make money management a breeze.

Let’s take a closer look at the groundbreaking benefits of integrating Xero into Pabau.

1. Automate invoicing and payments

The truth is, 57% of invoice data is still entered manually, which easily causes payment delays and revenue inconsistencies. Handling invoices and payments manually adds extra hours to your schedule and a huge task to your team’s to-do list.

But Xero solves all those issues for you, allowing faster and more accurate processing. Instead of printing or typing invoices, you can automatically create them in Pabau and sync them to Xero. If a payment comes into the bank, for example, Xero will match it to the outstanding invoice it refers to. You don’t have to check if the invoice matches the bill anymore. Xero transfers all data to Pabau, saving you time on extra calculations.

Getting more detailed financial reports gives you more control over your finances. You can compare your highest and lowest spenders, seeing where your revenue is coming from and what sells the most.

Here’s another cool thing you can do. Via the Pabau integration dashboard, you can easily upload previous invoices that you haven’t yet synced to Xero. Just filter the invoices you want to add by date. Sweet and handy, especially if you have a bulk of invoices to add, and not enough time in the day to do it.

Keep in mind — uploading unsynced invoices is only meant for salons and spas that have not integrated Xero into Pabau yet. Syncing Pabau invoices to an already-integrated Xero account might create duplicates in your records.

2. Less admin, more collaboration

Xero integration for salons and spas puts an end to the overbearing use of pen and paper. It also minimizes the back-and-forth with accountants and billers, keeping staff in the loop on the latest payments. You can see all invoices in a few clicks, and check their status — Pabau has been set to detect any Xero invoice errors and failed payments.

All processed payments and invoices — whether drafted, awaiting approval, or awaiting payment — will be stored in each client card, as well as in the Pabau integration dashboard. You’ll have all essential data in one place and can give your team simultaneous access to it, boosting collaboration and communication.

3. Improve revenue, expenses, and budgeting

Knowing how much revenue your salon or spa has accumulated is great. But knowing how and where that revenue is actually coming from and where your expenses are going opens a whole new opportunity for improvement. Since you’re not an accountant — phew! — tracking revenue or expense sources on your own can get hectic.

However, by integrating Xero into Pabau, you can use this little feature known as Xero account codes and get immediate access to your revenue, sales, and expenses.

Xero account codes are specific identifiers used to categorize different types of transactions. Think of account codes like labeling different items in a shopping cart. When you go shopping, each item you pick has its own label or code, making it easy to identify and organize at checkout. Similarly, in accounting, account codes are like labels for your products or services, such as specific beauty treatments or salon services.

By integrating Xero into Pabau, you can use account codes for line items, payments, and payment methods. Let’s see how you can make the most of each option.

1. Account codes for line items

Line item account codes apply to specific invoice items or services, like laser hair removal, massages, etc. They help categorize the revenue associated with the specific services, like haircuts, or products, like skin lasers, you offer.

How it helps — Using a line item account code helps you see where your money is coming from (revenue) and where it’s going (expenses) via a clear breakdown. If you’re a spa, you might use line item account code “610” for facials, “620” for massages, and “630” for specialty treatments like body wraps — and that’s how they’ll show up in Pabau and your reports. Having this breakdown helps target your most profitable services or products, which you can use to boost service offerings and marketing.

2. Account codes for payments

Like with line items, account codes can be used for payments, too. They help track and categorize the nature of the payment itself, regardless of the payment method. You’ll have a clear scope of which payments are most successful, which contributes to better reporting, and tax handling.

How it helps — assign payment account codes to track payments like memberships or bundles. Or, use them to manage different payment fees, like cancellation fees. You might use a code “500” to better track deposit payments — or code “600” for cancellation fees or late payments. This information will be registered by code in the Pabau dashboard, and in the patient records. You can segregate the type of payment that’s affecting your revenue the most, easily and from one place.

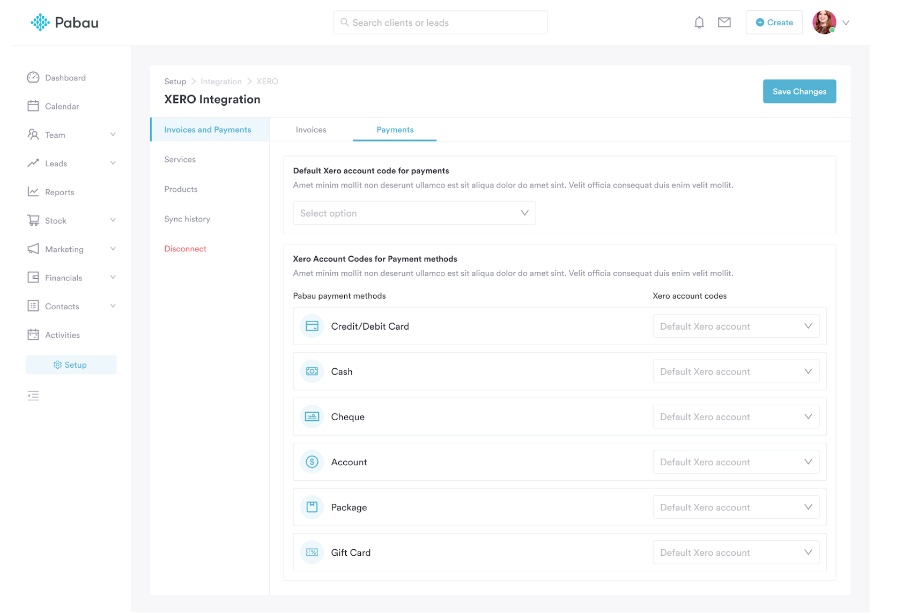

3. Account codes for payment method

Account codes can also be used to categorize and track how the payment was made. This can include payment methods such as credit card, Stripe, or cash. You can easily see where your biggest revenue comes from, and optimize your profit strategies while creating more accurate reports.

How it helps — assigning an account code for payment methods helps understand which payment method is preferred by your customers, or brings in the highest profits. For example, your salon or spa might use the payment method account code “701” for Klarna payments and “702” for payments made via the online bookings platform. At the end of each day, you can see how much revenue was generated through Klarna (code “701”) and online bookings (code “702”). Likewise, you can assign codes to track cash vs debit card payments, gift vouchers, etc., and have all details at a glance.

4. Better breakdowns and easier tax management

Your invoices and payments don’t have to be a pain in the neck, but they do need to be organized well. It’s the only way you can track your revenue, get precise reports, and file your taxes correctly. When it comes to taxes, integrating Xero into Pabau gives you much-needed data clarity.

In the Pabau integration dashboard, you can easily see the total cost for individual products or services, alongside the tax rate of each. Depending on the country your salon and spa operates in, taxes might be added to the total cost, or on top of it.

Either way, they will still appear in the final invoice and payment breakdown.

When tax season rolls in, you won’t have to worry. You can file without second-guessing your documentation or checking if your tax records are accurate. Taxes are easy to do when the numbers add up — and will help meet your tax obligations more efficiently.

5. Ensure data security

Patient data is a huge target among hackers — 88% of attacks in healthcare are related to financial records. Think about all the financial information your practice manages: the invoices and reports, the payments, and the billing details. That’s crucial data that is mandatory to secure, both under HIPAA law and in order to build trust among patients.

A leader in its field, Xero prioritizes top-notch cloud security. It delivers multiple layers of protection that safeguard the personal and financial information you handle. Xero’s cloud-based data is encrypted with bank-grade protocols and is securely stored in data centers monitored around the clock.

Pabau only adds to these measures. We use multiple security features, like 2FA, encryptions, and timeout sessions, for maximum security of any financial information you manage. You can be at ease knowing that invoices featuring sensitive patient information are synced and exchanged safely, without risks of exposure or theft.

Setting up Xero integration in Pabau 2

Integrating Xero to Pabau 2 applies to all invoices you created in Pabau, any changes you made to those invoices, as well as payments. But instead of clicking around, Pabau made navigating Xero integration for salons and spas a breeze.

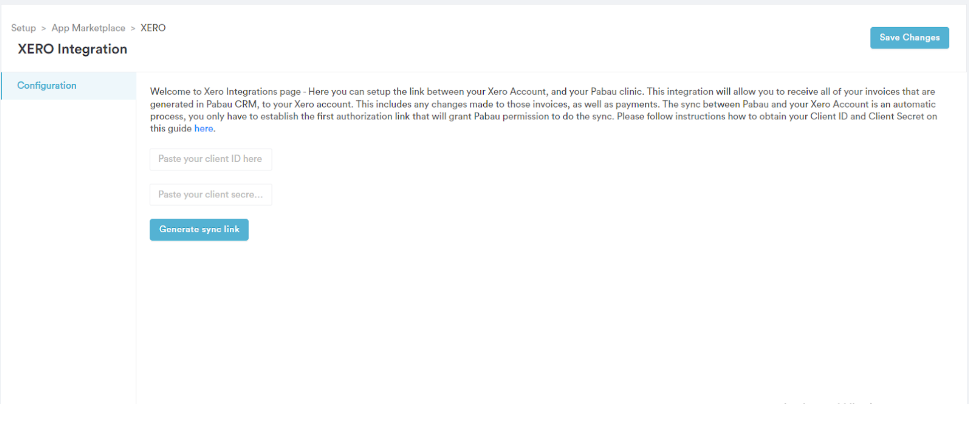

First, you need to activate the integration through Pabau, so the data is automatically synced to Xero. To do it, go to Setup ➡️ App Marketplace ➡️ Connected Apps ➡️ Financials ➡️Xero.

👉 When you first start to set up Xero, your Pabau dashboard will look like this:

👉 When you are done configuring, your Pabau dashboard will look like this:

About the integration itself —

1. If you are a Pabau 1 salon or spa and have already integrated Xero, you won’t have to reconfigure this in Pabau 2 — you’re good to go!

2. If you are setting up Xero for the first time, you will first need to create an Xero account. This is necessary so you can generate a Client ID and Client Secret, alongside an authorization link that’s needed for the sync to Pabau.

To generate a sync link and obtain a Client ID and Client Secret (a unique piece of information needed to identify the client application), follow our easy guide HERE.

Xero integration for salons and spas — make it count with Pabau 🫰

Keep your revenue close and your patients closer!

By integrating Xero into Pabau, you won’t have to worry about tracking money again. Whether you’re doing year-end submissions, boosting revenue, or filing taxes, Pabau will keep your financial information in one place, accurately processed, and available when you need it.

Xero is a no-brainer for salons and spas. It takes away the pressure of having to manage everything, everywhere all at once, and makes managing your finances and patients a breeze — no ‘girl math’ required!