Payment reconciliation – the very phrase sounds a bit snooze-worthy, doesn’t it?

But, as you know, if you want your spa’s cash flow in order, this practice is key.

The problem is, ensuring all your payments match up can be tedious and frustrating, especially if you lack the right tools and integrations.

If your payment reconciliation process feels like it needs a serious makeover, or you’re on the hunt for integrations to improve your existing system, you’ve come to the right place.

We’re about to dive into:

- The challenges surrounding payment reconciliation for spas

- How the right integrations solve those problems

- 3 systems that integrate with top-tier payment reconciliation tools

Let’s get started!

Challenges of manual payment reconciliation in spas

If only payment reconciliation were as relaxing as a spa treatment! We wouldn’t even have to worry about accounting software, payment processors, and any integrations.

Sadly, the reality is far from it. There are a host of challenges that can make this process a nightmare, leading to lost revenue, wasted time, and even damaged client relationships.

Let’s explore five of the most common culprits.

Managing multiple payment methods

Today’s spas need to give clients a flexible checkout experience.

Even with the recent decline in credit card payments, there are still a lot of payment types to consider. Digital payments, contactless payments, debit cards, gift card payments, third-party financing, buy now, pay later (BNPL) options… the list goes on.

While these payment options are great for customers, it’s a hassle on the administrative side.

Juggling different payment systems, each with its own reporting formats leads to a higher chance of discrepancies and makes it tough to get a clear overall picture of your finances.

Tracking appointments and associated payments

Imagine a busy spa day with your front desk dealing with cancellations, no-shows, and maybe some package deals with partial payments upfront.

Now, try to track all those changes manually across separate payment service providers, point-of-sale (POS) transactions, and potentially paper records of deposits or refunds. All the while ensuring that you have an efficient checkout process.

Did the no-show client prepay through our mobile app or leave a deposit? Was the package pricing correctly reflected in the final payment?

This is a recipe for wasted time chasing discrepancies and lower profitability if payments go untracked.

Reconciling with bank statements and merchant accounts

Matching a spa’s internal records with transactions on bank statements and credit card merchant accounts can be incredibly tedious.

The challenge is making all three sides of this financial triangle – your records, the bank’s, and the data in any credit card processing tools align perfectly.

Without a great tool to sync these three sources of data, it’s easy for errors to slip through the cracks.

Differences in timing (when a payment is processed versus when it clears), fees, chargebacks, and the sheer volume of transactions make it all too easy to miss discrepancies that can add up over time.

Time-consuming and labor-intensive process

When you get down to it, payment reconciliation eats up valuable staff time, diverting their attention from critical tasks like enhancing the customer experience and patient care.

It’s a no-brainer that hours spent poring over spreadsheets, matching payment records, and chasing down errors could be much better spent elsewhere and is probably not good for morale.

But, even when you try to delegate reconciliation, it inevitably gets pushed down the priority list during busy days. This creates a backlog of financial work that can quickly become overwhelming, leading to further delays and complications.

Prone to errors and inconsistencies

Let’s face it, humans make mistakes. Even the most careful and meticulous staff members are not immune when sifting through mountains of payment data.

Transposed numbers, overlooked transactions, and miscalculated totals – without the right tools these errors can slip through the cracks, leading to costly consequences.

Overpayments, underpayments, or unexplained discrepancies leave a lingering sense of uncertainty within your spa’s finances. Even worse, mistakes can damage client trust and create disputes that are awkward to resolve.

Benefits of payment reconciliation integrations

OK, we’ve covered the challenges of payment reconciliation, and they’re a doozy.

But there’s good news! The right integrations can smooth out those wrinkles and bring significant benefits to your spa.

Let’s dive into how they can transform your financial management.

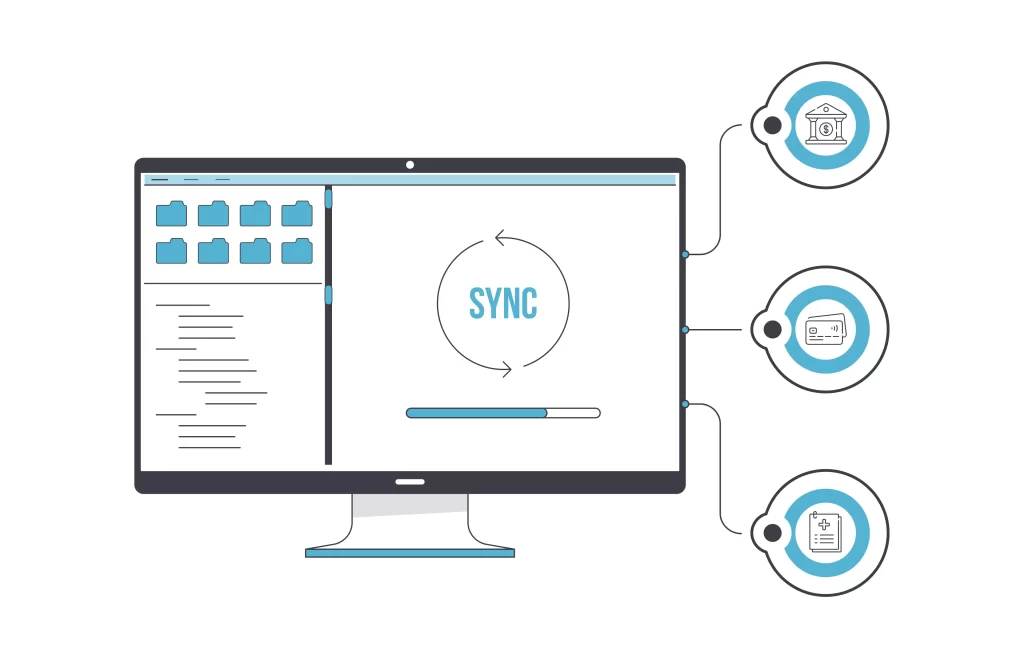

Automatic data import from various sources (appointment booking systems, POS systems, merchant accounts)

Imagine your spa’s different software systems “talking” to each other about payments, eliminating the need for you to be the messenger!

Payment reconciliation integrations do exactly this by establishing direct links between your booking software, POS, and merchant accounts.

Whether by API, a flexible way for different software systems to share data, or direct, custom-built integrations, the systems use automation to pull transaction details like date, amount, client ID, and service rendered between each other.

When all of this data is collected in one place, say a clinic management system, you create a centralized, up-to-date record of financial activity.

Match transactions and identify discrepancies

Forget about manually comparing lists and squinting at spreadsheets to make sure everything lines up.

Reconciliation software with quality integrations uses sophisticated algorithms to analyze the imported data from your different systems. It matches transactions based on criteria like date, amount, and customer information.

Any discrepancies, whether a missing payment in your booking system or a charge on your merchant account without a matching transaction, are immediately flagged, directing your attention to potential errors or issues that need investigating.

Reduce manual data entry and errors

Every time you type in a transaction amount, client ID, or payment date, you’re opening the door for a typo or error.

Say you processed a $100 refund in your POS, but when manually entering it in your accounting software, you accidentally type $10. This $90 discrepancy will leave you scrambling to figure out what went wrong down the line, wasting valuable time.

Payment reconciliation integrations slam that door shut by directly importing data from your other systems. Instead of manually re-entering payment information, the refund would automatically be populated within your reconciliation tool.

This benefit dramatically reduces the chance of costly mistakes and ensures your financial records stay squeaky clean.

Saved time and resources

All those benefits we’ve discussed add up to serious time and resource savings for your spa.

By automating tasks like data entry and transaction matching, integrations free up staff hours that were once lost to tedious manual work.

But it’s not just about saved time – think of the resources conserved! Less manual data entry means less wasted paper, fewer errors mean less administrative hassle, and a reduced chance of costly mistakes.

After all, a single missed payment or an uncaught double charge could lead to lost revenue, client disputes, or even compliance fines.

Improved accuracy and efficiency

With payment reconciliation integrations, you don’t have to choose between a fast process and a perfectly accurate one – you get both!

Think about it: these integrations eliminate the chance of human error inherent in manual data entry. They automatically match transactions across systems, reducing discrepancies and flagging any inconsistencies.

This means you get a clear, trustworthy picture of your finances which is the ideal foundation for making smart business decisions.

The 3 payment reconciliation integrations for spas in 2024

So, we’ve talked about how important integrations are for your spa. Now, let’s dive into the good stuff – the actual tools that can make that happen.

These next sections will explore three powerful software solutions known for their top-notch payment reconciliation integrations.

Let’s jump right in!

1. Pabau

Pabau is an all-in-one practice management solution designed specifically for the complexities of medspas. Beyond core features like scheduling and client records, it includes marketing tools, online booking, and its own integrated payment processing solution, Pabau Pay.

Pabau Pay makes reconciliation a breeze. Payment data from different channels and payment processors like Google and Apple Pay automatically sync within Pabau. This drastically reduces manual data entry, errors, and the need for time-consuming cross-referencing.

While the core strength is its all-in-one approach, Pabau has the following integrations to extend its functionality:

- Xero

- Healthcode

- Stripe

If you’re tired of battling spreadsheets and fragmented systems, Pabau’s streamlined approach to payment reconciliation is absolutely worth exploring.

2. Phorest

Phorest brands itself as salon management software, making it popular with hair and beauty salons. It offers scheduling, point-of-sale, client management, and basic payment processing capabilities.

While not as robust as a dedicated reconciliation tool, Phorest can help manage payment data within its system.

Phorest offers PhorestPay for cardless payment processing but has only a few other integrations to support payment reconciliation, the three of them being:

- Stripe

- Xero

- QuickBooks

Phorest can be a starting point for spas seeking basic payment reconciliation alongside their core salon management needs.

3. Zenoti

Zenoti is a cloud-based software solution catering to the spa and salon industry. It boasts a wide range of features, including appointment scheduling, marketing tools, inventory management, and its own payment processing.

Zenoti’s payment processing features include the ability to track payments and perform basic reconciliation tasks.

For greater flexibility, Zenoti offers the following integrations:

- Stripe

- Oracle Netsuite

- Xero

- QuickBooks

- Sage

Overall, Zenoti is worth considering for spas that want a comprehensive software solution with some useful payment reconciliation integrations.

Accelerate payment reconciliation processes with Pabau

With that, we’re done with our dive into payment reconciliation.

While some of the integrations we mentioned can really streamline this process, adding more and more tools to your existing setup can get pricey and complicated.

That’s why sometimes, an all-in-one solution like Pabau might be a better fit.

With Pabau Pay, you get a fully integrated system that works seamlessly with Pabau’s practice management software. Payments from online bookings, in-person terminals, and other channels are synced instantly and automatically.

Plus, with a few clicks, you can access detailed reports to view and compare all your stored payments.

This translates into stress-free payment management, freeing you up to focus on what matters most – your clients and your business. So you can say goodbye to tedious manual data entry and enjoy some peace of mind.

Explore Pabau’s payment terminals and see how they can make your life easier!