As a med spa owner, you want to help people look and feel their best. However, the business side of things can be daunting, especially when it comes to payment processing systems.

A smooth and pain-free checkout experience is the cherry on top of your client journey. And as technology evolves, more and more clients are making purchases without cash. They want convenient systems that help them pay quickly, in-person or when booking online.

That’s why having the right tools to process payments securely and efficiently is crucial. An integrated payment processing tool that can handle card and contactless payments, remove friction, and even add tips, is a game-changer for your med spa.

There are also great benefits for you, too. Less time spent processing payments, less likelihood of human errors, and fewer headaches about payments!

Let’s dive into the top nine integrated payment processing tools and how to choose the best fit for your med spa.

What is an integrated payment processing tool?

An integrated payment processing tool connects to your POS, automatically recording payments and transactions into your system.

It allows your clients to pay with different payment methods like credit cards, debit cards, and mobile wallets, without needing a third-party tool or manual data entry to process payments.

To put it another way, a payment processor acts as the bridge between the checkout process and your practice management system.

Imagine all your business ducks in a row, where your appointment scheduling software, electronic health records (EHR), and payment processing talk to each other.

A med spa software with an integrated payment gateway allows you to:

👉 Take payments in a matter of seconds

👉 Sync your payments with your calendar and clients’ files

👉 Have a clear overview of all your transactions

👉 Manage your finances hassle-free from one place

Features to look for in an integrated payment processing tool

When choosing your perfect fit, consider these key features:

☑ Ease of use and integration: You shouldn’t need a technology degree to install a payment processing tool! Look for a system that’s intuitive and integrates smoothly with your existing software. The solution should have a no-code setup or user-friendly onboarding.

☑ Supports a wide range of payment methods: Your clients want options – debit cards, credit cards, Stripe, digital wallets, Apple Pay, Google Pay, and even recurring billing. A comprehensive payment processing solution should be able to accommodate these methods.

☑ Security: This is paramount. Clients want to know their financial safe is safe. Make sure the payment gateway provider complies with industry security standards and provides the highest level of PCI compliance (PCI DSS – Payment Card Industry Data Security Standard).

☑ Seamless checkout experience: It should be a breeze for your clients to checkout. A solid payment processor should be user-friendly and enable payment processing in a matter of seconds, maximizing cash flow and conversions if clients book online.

☑ Reporting and analytics: It’s all about data, data, data. Having access to real-time reporting is crucial for the financial health of your med spa or salon.

The top integrated payment processing tools for small businesses

Here are some of the best payment gateway contenders to consider.

1. Pabau

Pabau is designed with med spas, salons, and clinics in mind. It goes beyond just processing payments, offering a comprehensive suite of tools to manage your entire business.

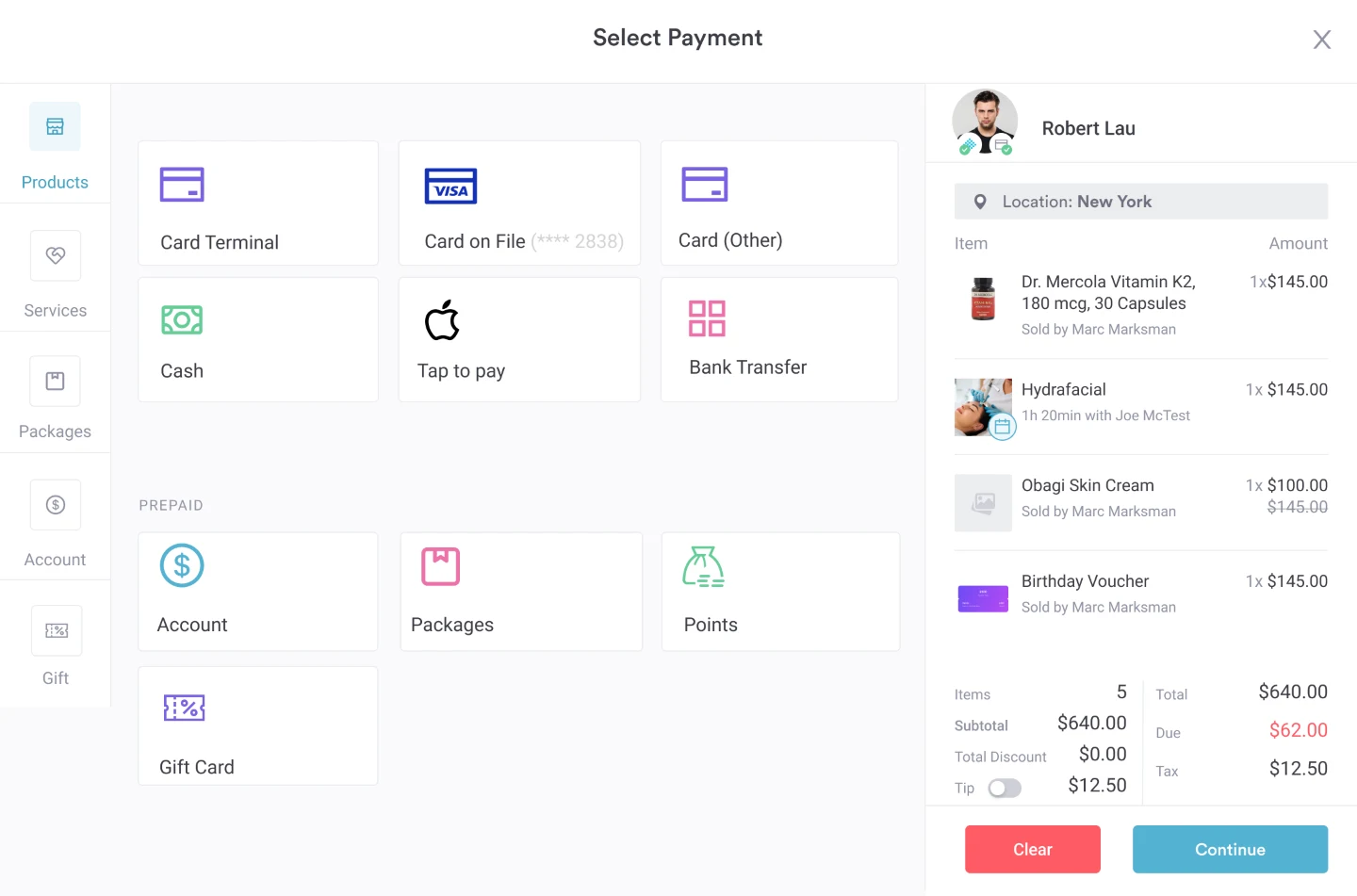

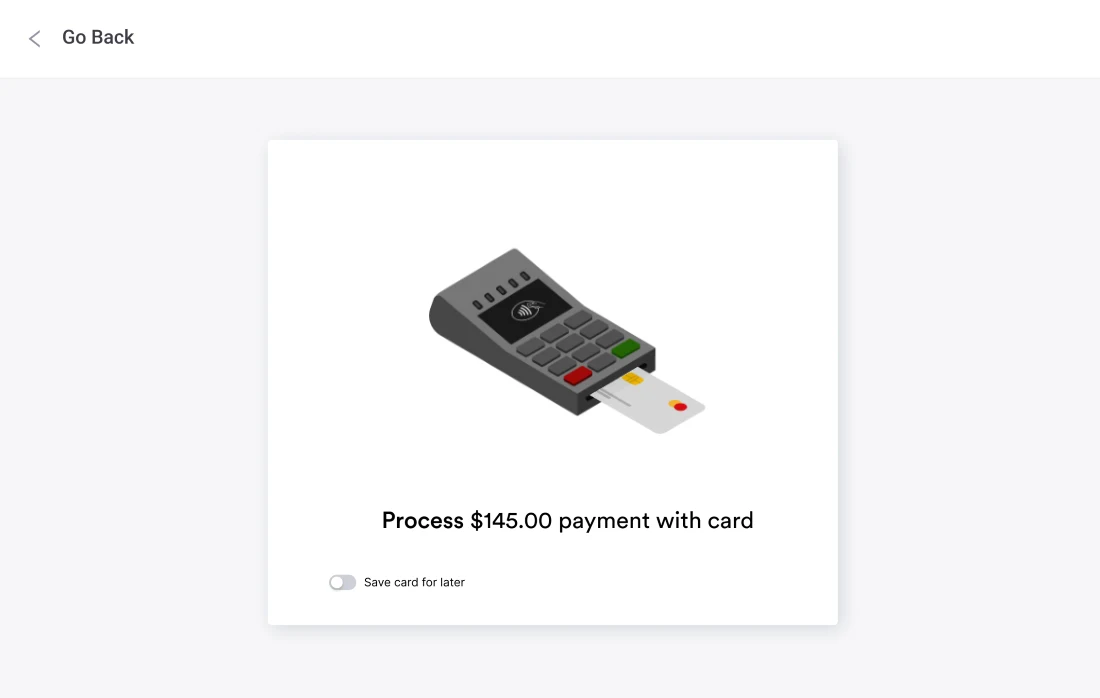

The integrated Pabau Pay card terminal syncs with your PoS, online bookings, schedule and client files, allowing you to view transaction history and create sales reports.

With the Pabau payment gateway, you can charge your clients using their preferred payment method online or in person, via major debit and credit card transactions by tap or pin – Mastercard, Visa, American Express, and digital wallets like Apple Pay and Google Pay.

You charge clients partially via Stripe for more expensive treatments, or save their card on file, providing a frictionless checkout experience.

You get not only an automated payment processor but also a robust practice management system under the same roof. As it syncs with your client records, Pabau Pay is super convenient, reduces the risk of errors and saves time with payment reconciliation.

Fees – starting from 3.1% + 25 cents per transaction (US) and 1.35% + 20 pence (UK) (*fees apply to Pabau Pay payment processing only).

Key features and benefits

- Pabau Pay card terminal integrated into practice management software

- Accepts Mastercard, Visa, American Express, Google Pay and Apple Pay

- Partial payments with pin and tap

- Allows for tips

- Rapid access to payouts

- Real-time payment data synced into the practice management system

- Flexible payment methods

- Integrates with Stripe, GoCardless and Xero

2. Stripe

Stripe stands out as an extremely flexible payment processor, supporting a wide range of payment methods and more than 135 currencies. It’s a good choice for online businesses with international customers, and those that want online payment processing on their websites.

Stripe Terminal integrates with a point-of-sale system for in-store payments. You can fully customize your checkout flow through API, but you’ll need to know how to implement code.

Stripe is a great match for businesses selling online as it accepts payments from various channels like e-commerce shops, marketplaces and subscription-based payments. However, you’ll need to be comfortable with coding or have a developer at hand to take full advantage of its customization capabilities.

Fees – 2.7% + 5 cents for in-person, 2.7% + 30 cents for online transactions; Stripe Terminal starts from $59.

Key features and benefits

- Accepts major credit cards and digital wallets (PayPal, Cash App Pay)

- Stripe Terminal

- Flat rates and option for no monthly fee

- Best for online payments

- Integrates with Shopware, Xero, GoFundMe WooCommerce

3. Square

Square is an all-around point-of-sale software suitable for small businesses that mostly take mobile payments. Square comes with a long list of hardware features and functionalities, including a free mobile card reader.

It’s a powerful payment gateway provider that comes with a free robust POS, an online store builder with payment processing and a wide choice of terminals.

However, it only works on iOS and Android devices. Also, its POS system lacks industry-specific features.

Fees – 2.6% + 10 cents for in-person, 2.9% + 30 cents for online transactions; Square magstripe-only card reader is free, other card readers and terminals start from $49.

Key features and benefits

- Free POS system and mobile card reader

- Various payment processing terminals

- Flat rates

- Fee plan & no monthly fee options

- Integrates with QuickBooks, Xero, WooCommerce, and GoDaddy, among others

4. Braintree

Braintree is an integrated payment platform owned by PayPal. It’s ideal for businesses that take online and mobile app payments.

Braintree supports major credit and debit cards but triumphs in taking payments through digital wallets, such as PayPal, Venmo, Google Pay, Apple Pay, Samsung Pay, and others.

Besides providing seamless and trusted payment methods, Braintree offers sturdy fraud protection, with the highest level of PCI compliance. You can also get detailed reports of your transactions.

Fees – digital wallet and card payments 2.59% + $0.49, Venmo payments 3.49% + $0.49, ACH payments 0.75% fee up to $5

💡 ACH payments refer to electronic, bank-to-bank money transfers processed through the Automated Clearing House Network. ACH transfers allow for safe money transfers online, such as for direct deposits or bill paying.

Key features and benefits

- Major digital wallet, debit and credit card processing

- Integrated payment processing tool for mobile and online transactions

- Buy-now-pay-later options

- Advanced security features and no monthly fee

- Integrates with WooCommerce, Magento, and TaxCloud, among others

5. Helcim

Helcim is an all-inclusive payment platform for small and medium-sized businesses.

Additionally, Helcim offers merchant accounts, virtual terminals, and smart terminals for in-store and on-the-go payments.

However, it may be a bit pricy for med spas and salons with low sales volume.

Compared to other payment gateway solutions with flat rates, Helcim offers an Interchange Plus pricing model, which is marketed as a saving method.

Because of their pricing structure, it’s a good fit for high-volume sales businesses.

💡 The Interchange Plus model is Helcim’s transparent way of charging fees for processing transactions, and unlike other payment processing companies, allows you to understand exactly what you’re paying for. Helcim offers volume-based discounts, meaning that as your monthly transaction volume increases, their margin decreases, resulting in lower processing fees for businesses with higher transaction volumes.

Fees – 0.40% interchange plus fee + $0.08 per in-person payment, 0.50% interchange plus + $0.25 per transaction for online payments, 0.5% + $0.25 for ACH payments

Key features and benefits

- A comprehensive point-of-sale system with a merchant account, virtual terminals and mobile app for payments on the go

- Flexible payment processing options (in-person, online, in-app)

- POS built into merchant software

- No monthly fee

- Integrates with Xero, QuickBooks, WooCommerce

6. Clover

Clover is primarily a point-of-sale system for in-person payments, with one of the lowest in-person transaction fees on the market. Their hardware and services are geared toward restaurants, retail stores and service businesses.

Their all-in-one POS system allows business owners to take payments through various card options, track sales and inventory and manage staff performance.

Payment processing fees are linked to Fiserv – its parent company. The cost may vary if you choose another merchant provider. There are no free options and you must sign a lengthy contract lasting 12-36 months.

It’s probably not the best fit if you mostly take online payments. Clover can cover your basic POS needs, but it lacks business-specific features your med spa needs, such as comprehensive online payment integration, customizable deposits, and subscription and membership management.

Fees – Monthly fees start at $14.95; 2.3% + 10 cents for in-person transactions and 3.5% + 10 cents for online transactions.

Key features and benefits

- All-in-one POS system

- Diverse card readers and POS devices

- Low rates for in-person payments

- Feature-rich POS system

- Integrates with QuickBooks, WooCommerce, MailChimp

7. Stax

Stax (formerly Fattmerchant) is a payment processing platform offering merchant services and flexible payment processing methods. Its flat-rate subscription-based pricing and 0% markup on interchange make it an attractive solution for businesses.

💡 Merchant services refer to various payment-related tools and services enabling businesses to accept payments from customers for products and services. This includes everything from POS systems, payment gateways, card readers, and online payment processing to gift cards and loyalty programs, and more.

Stax’s biggest advantage is that there are no contracts, plus businesses get a free terminal or card reader. Also, you save money if your clients use cards with low interchange rates.

However, their subscription prices are determined per processing volume. It’s a viable option for your med spa if you are making between $5,000 and $500,000 in card transactions yearly.

If your sales volume is lower than $5,000, it won’t offset the subscription fee.

Fees – 0% + $0.08 for in-person and 0% + $0.15 for online payment processing; monthly fees start at $99.

Key features and benefits

- Subscription-based pricing

- Free terminal and card reader

- Unique add-ons like one-click shopping carts

- Integrates with QuickBooks, Xero, HubSpot, Zoho, MailChimp

8. Elavon

Elavon is an international payment processing company operating in more than 36 countries and supporting more than 131 currencies, which is great if you have clients around the world.

As a U.S. Bank subsidiary, Elavon is a trusted choice among businesses of any size. It offers dedicated merchant accounts, and is equipped with a long array of seamless hardware and software solutions for in-person and online transactions like mobile wallets, in-app payments and tap-and-go.

However, Elavon doesn’t display its pricing transparently, a huge setback for small businesses. Also, there’s no clear turnaround time for receiving payments – it might take 48 hours or more.

Fees – You’ll have to get in touch with their team for more details about their processing and transaction fees.

Key features and benefits

- A wide choice of in-person and online payment processing solutions

- Dedicated merchant account

- Easy-to-use contactless checkout

- Key integrations with more than 180 tools, including Microsoft Dynamics 365, WooCommerce, Sage 50

9. Shopify

Shopify Payments is the integrated payment processing solution in the Shopify e-commerce platform. You don’t need to install any third-party payment provider and you can start accepting payments from the get-go. All your sales and payment information is stored in the Shopify ecosystem.

If you want to use your own payment gateway, Shopify will charge a fee on top of the card processing fee. Shopify accepts various payment methods and major credit cards.

A free Shopify POS comes with all plans except the Starter Plan. There are no lengthy contracts and you can cancel at any time.

But, Shopify is mostly retail-focused and might not be a good fit for med spas. Also, it’s not available in all countries and doesn’t work with high-risk businesses.

Fees – Fees depend on the plan; in-person start at 2.7% per transaction, online start at 2.9% + $0.30 per transaction; monthly fees start at $15 (Starter)

Key features and benefits

- Integrated and ready-to-use payment solution in the Shopify ecosystem

- Various payment methods: Visa, Mastercard, American Express, PayPal, Apple Pay, Facebook Pay, Google Pay, and Amazon Pay

- Transparent flat rates and no long contracts

- Free POS with every Shopify plan (except Starter)

- Ability to customize your checkout page

Elevate your payment processing with Pabau

Your med spa doesn’t only need a payment processor – it needs an integrated, all-in-one payment processing system that automates and consolidates payment data across your entire practice management system.

Many tools offer multiple payment methods, low fees and flat rates. But only Pabau is specifically designed for med spas and clinics – it knows what your business needs and it delivers.

Pabau processes, automates and syncs your payments across your entire business, including calendar, bookings, client files and reports, allowing you crystal clear insights and smooth operations.

Our Pabau Pay terminal allows your clients to choose their preferred payment method. While you get secure and timely payouts, less manual work and an easier life. Plus, it allows for clients to leave you tips

Swipe away your pains and take payments with ease with Pabau Pay.